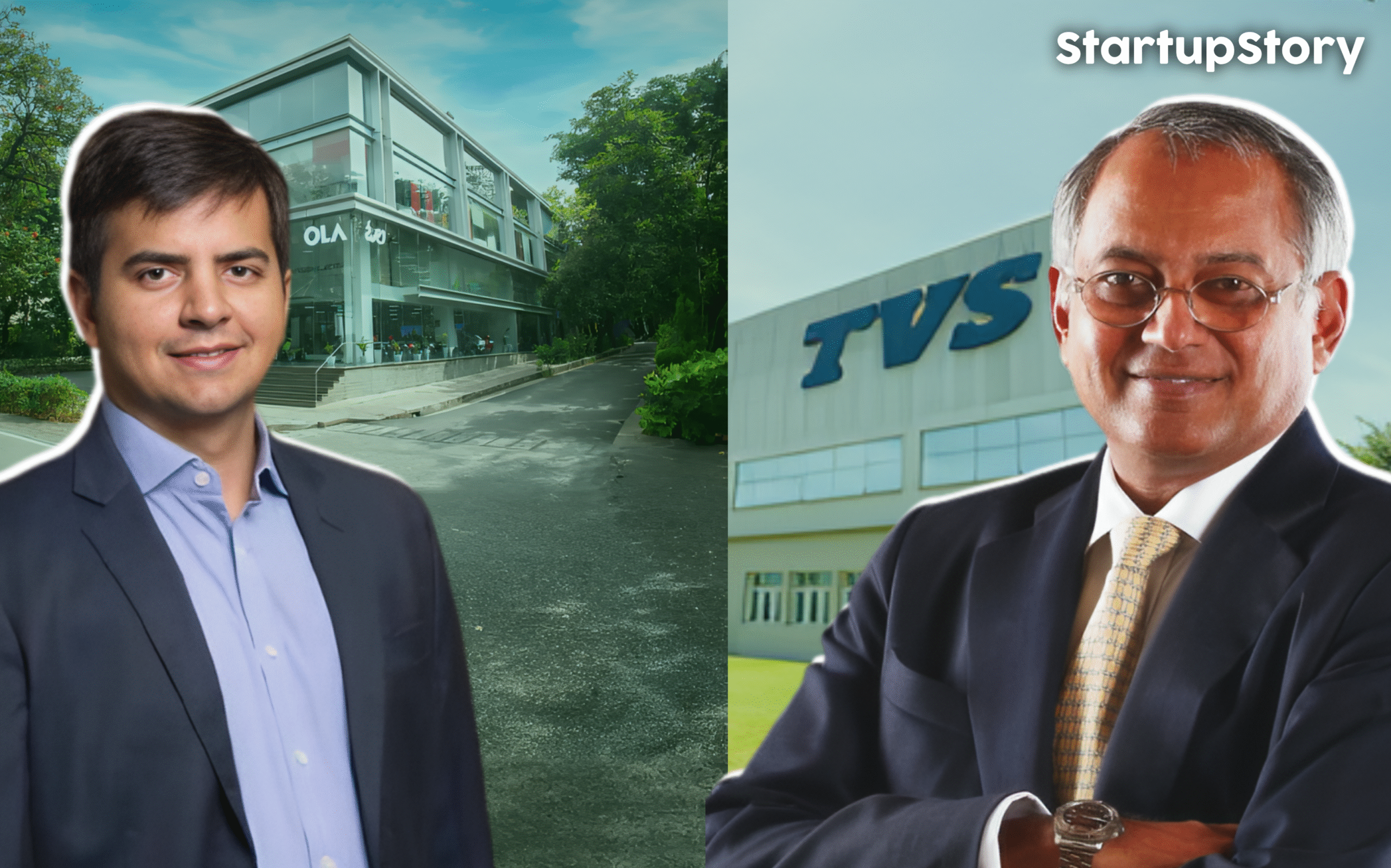

Revolutionary Move by Indian EV Manufacturers:

Indian electric vehicle manufacturers Ola Electric and TVS are making a groundbreaking strategic shift by adopting ferrite-based motors in their electric scooters. This transition represents a significant move away from traditional rare earth magnets, aiming to reduce dependence on imported materials and strengthen supply chain resilience.

Ola Electric plans to introduce new electric vehicle models powered by ferrite magnets in the third quarter of 2025 (September-December), marking a crucial milestone in the company’s technology development. According to sources familiar with the development, Ola has been working with global partners for over two years to develop and re-engineer ferrite-based motor technology that delivers both high efficiency and strong performance.

The company has already completed internal validation and testing of these prototype motors on select vehicles, demonstrating the viability of this alternative technology. This initiative is particularly significant as Ola Electric CEO Bhavish Aggarwal confirmed that the company will launch rare earth magnet-free motors by the second quarter of FY2025-26.

TVS Motor Company’s Parallel Development:

TVS Motor Company is actively pursuing similar ferrite motor technology development, although the company has not issued official statements about their progress. Industry insiders indicate that TVS is exploring various alternatives to rare earth magnets, demonstrating the broader industry commitment to reducing supply chain vulnerabilities.

Understanding Ferrite Magnets vs. Rare Earth Magnets:

Advantages of Ferrite Magnets:

Ferrite magnets offer several compelling advantages over rare earth alternatives:

Cost and Availability: Ferrite magnets are widely available and significantly more cost-effective than rare earth magnets. They can deliver 2-3 times the magnetic field per dollar spent compared to neodymium magnets.

Supply Chain Security: Unlike rare earth magnets that are predominantly sourced from China, ferrite magnets have global availability, making them less vulnerable to geopolitical risks and supply disruptions.

Temperature Stability: Ferrite magnets can withstand temperatures up to 300 degrees Celsius and their coercivity actually increases as temperature rises, making them more resistant to demagnetization at higher temperatures.

Corrosion Resistance: Ferrite magnets are naturally corrosion-resistant and do not require additional protective coatings, unlike rare earth magnets which are prone to oxidation.

Performance Trade-offs:

However, ferrite magnets do have certain limitations compared to rare earth alternatives:

Lower Magnetic Strength: Ferrite magnets typically deliver magnetic fields of 800-1000 gauss, significantly lower than neodymium magnets which can reach approximately 3500 gauss. The magnetic flux of ferrite magnets ranges between 0.5 and 1 Tesla, compared to rare earth magnets at about 1.4 Tesla.

Weight Considerations: Motors using ferrite magnets are typically 30% heavier than those using rare earth magnets, even with optimized designs. A typical rare earth motor uses 1-2kg of magnets, while ferrite motors would likely require double or triple that amount.

Power Density: Ferrite magnets have lower magnetic energy products, ranging from 230 to 430 MT (megatesla), compared to higher-performance rare earth alternatives.

Global Industry Context and China’s Rare Earth Dominance:

China’s Strategic Control:

China maintains overwhelming control over the global rare earth supply chain, producing approximately 60% of the world’s rare earth raw materials and processing about 85-90% of global output. Most critically, China manufactures nearly 90% of the world’s rare earth magnets and controls virtually all refining capacity for heavy rare earth elements essential for high-performance magnets.

Export Restrictions and Industry Impact:

In April 2025, China imposed stricter export controls on seven rare earth elements – samarium, gadolinium, terbium, dysprosium, lutetium, scandium, and yttrium – requiring special export licenses and detailed end-use disclosures. These restrictions have prolonged the approval process to at least 45 days, creating significant delays and tightening global supply chains.

The impact has been substantial, with magnet exports dropping by 75% in the two months following the restrictions, forcing several global automakers to pause production. This supply disruption has particularly affected India’s automotive and white goods sectors.

Indian Government Response and Policy Support:

Government Strategy:

Indian Commerce and Industry Minister Piyush Goyal described China’s rare earth export restrictions as a “wake-up call for the whole world,” emphasizing the need for trusted partners in supply chains. The government has outlined a comprehensive strategy including:

Diplomatic Engagement: Ongoing discussions through the Indian embassy with Chinese authorities to expedite approval processes.

Alternative Supply Sources: Active efforts to identify and develop alternative supply chains beyond China.

Domestic Capacity Building: Strengthening Indian Rare Earths Limited (IREL) with necessary resources to accelerate domestic production capabilities.

Industry Research and Development:

The Automotive Research Association of India (ARAI) has published a white paper emphasizing the growing need for customized magnet solutions. ARAI suggests that with new suppliers and design innovations, India can take significant steps toward building domestic capabilities in permanent magnet technology.

Technological Innovation and Industry Adaptation:

BOSCH’s Implementation:

German multinational engineering company BOSCH has already implemented ferrite magnets in some of their electric motors, demonstrating the technology’s viability in commercial applications. BOSCH’s Global Blower Motor (GBM) uses a 2-pole DC motor with ferrite magnets, while their Global Brushless Blower (GBB) features a 12/10 topology with ferrite magnets.

Startup Innovation:

Several Indian startups are developing rare earth-free motor technologies:

Chara Technologies: A Bengaluru-based deep-tech startup developing rare earth magnet-free motors, with founder Bhakta Keshavachar actively engaged with government officials on long-term solutions.

Numeros Motors: Working with IIT Bhubaneswar on a two-year research project exploring non-magnet motor topologies and rare earth-free alternatives.

Sterling Gtake E-Mobility: Signed a technology licensing agreement with UK-based Advanced Electric Machines (AEM) to produce rare earth magnet-free electric motors.

Alternative Motor Technologies:

Induction Motors:

Induction motors represent a viable alternative to permanent magnet synchronous motors, offering several advantages:

- Robust construction with no permanent magnets required

- Lower maintenance requirements and longer lifecycle

- Comparable efficiency to permanent magnet motors when combined with advanced control techniques

Tesla has already shifted toward induction motors to reduce dependency on Chinese rare earth materials.

Switched Reluctance Motors (SRM):

SRM technology offers another promising alternative:

- Simple rotor construction with laminated steel and no windings or permanent magnets

- Higher acceleration capability due to low rotor inertia

- High power density suitable for larger vehicles

- Easier thermal management with heat concentrated in the stator

Future Outlook and Market Implications:

Industry Predictions:

According to IDTechEx research, nearly 30% of the electric vehicle market will be using rare earth-free motors by 2035, including both ferrite-based and magnet-free motor technologies. This transition reflects growing concerns about supply chain security and the drive for geopolitically stable component sourcing.

Performance Optimization:

While ferrite magnets have inherent limitations, ongoing research focuses on optimization strategies:

- Advanced motor design techniques to compensate for lower magnetic strength

- Improved control systems and software optimization

- Integration with high-silicon steel and high-conductivity copper alloys to enhance overall motor performance

The shift toward ferrite magnets by major Indian EV manufacturers represents more than just a technological change-it’s a strategic move toward supply chain independence and sustainable manufacturing. As companies like Ola Electric and TVS continue developing these technologies, they’re positioning India as a leader in innovative, geopolitically resilient electric vehicle manufacturing.

This transition, supported by government policy and driven by startup innovation, demonstrates how supply chain challenges can catalyze technological advancement and industry evolution. While ferrite magnets may require larger motor designs and careful optimization, they offer the critical advantage of supply security that rare earth alternatives cannot match in the current geopolitical landscape.