Hudle, a fast-growing sports‑tech platform, has secured $2.5 million in Series A funding to expand its reach across India’s recreational sports community. Led by Sky Impact Capital, with backing from Physis Capital, Atrium Venture, and key angel investors including Mahesh Bhupathi, Gaurav Kapur, and founders of Blue Tokai and Nitro Commerce, this funding marks a major milestone in Hudle’s journey.

Funding Details & Investors

- Series A Raise: $2.5 million

- Lead Investor: Sky Impact Capital

- Additional Backers: Physis Capital, Atrium Venture, plus notable angels

This newly raised capital builds on Hudle’s earlier ₹7 crore (~$870,000) pre‑Series A round in April last year, led by Inflection Point Ventures.

Goals for Expansion & Innovation

The funds will enable Hudle to:

- Expand its venue network across more cities.

- Enhance features on its platform for users.

- Launch a new player rating system, the Game Rating Index for Players (GRIP), debuting in August 2025 for sports like badminton, pickleball, and padel.

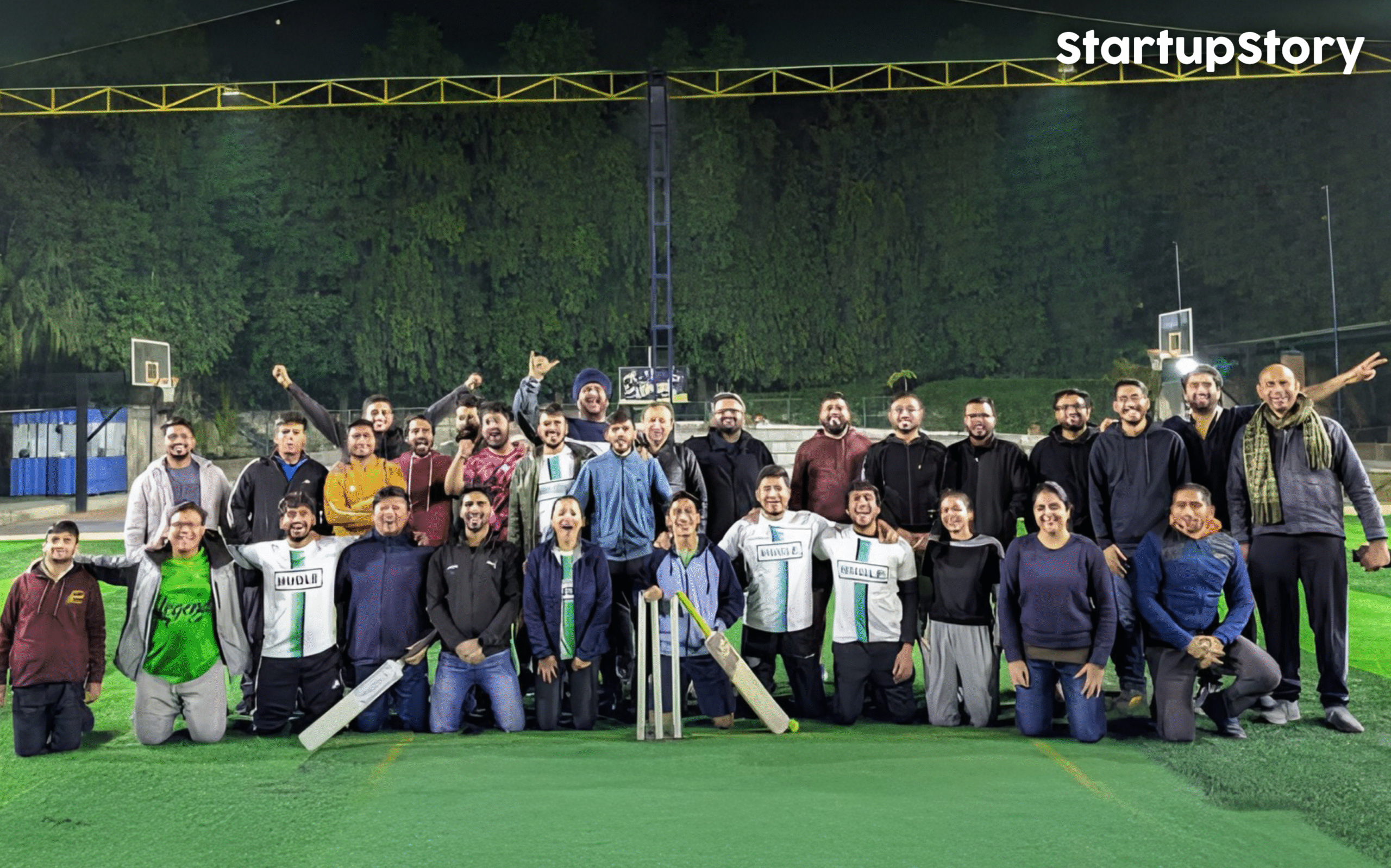

Platform Reach & Growth

- Founders: Suhail Narain, Arjun Singh Verma, and Sonam Taneja.

- Coverage: Over 2,000 sports venues in 60 Indian cities.

- Monthly Activity: Facilitates more than 150,000 games. The goal is to exceed 3 million games by the end of this fiscal year.

Technology & Business Performance

- Core Features: Real‑time booking, player performance tracking, smart game‑matching algorithm.

- Growth in Numbers: Revenue has grown 2.5×, and gross transaction value over 3.5× in the past year .

What’s Next: GRIP System & Beyond

Hudle’s upcoming GRIP rating system will give players transparent, quantitative performance rankings in emerging sports like pickleball, padel, and badminton. This feature launches in August 2025, aiming to boost player engagement and competitive spirit.

Why It Matters:

- Scaling Recreational Sports: Hudle is addressing India’s growing demand for easy access to organized sports outside traditional leagues.

- Empowering Players: Through data and community features, players gain insights and motivation.

- Investor Confidence: Participation by high-profile investors underlines the platform’s strong market potential and technology innovation.