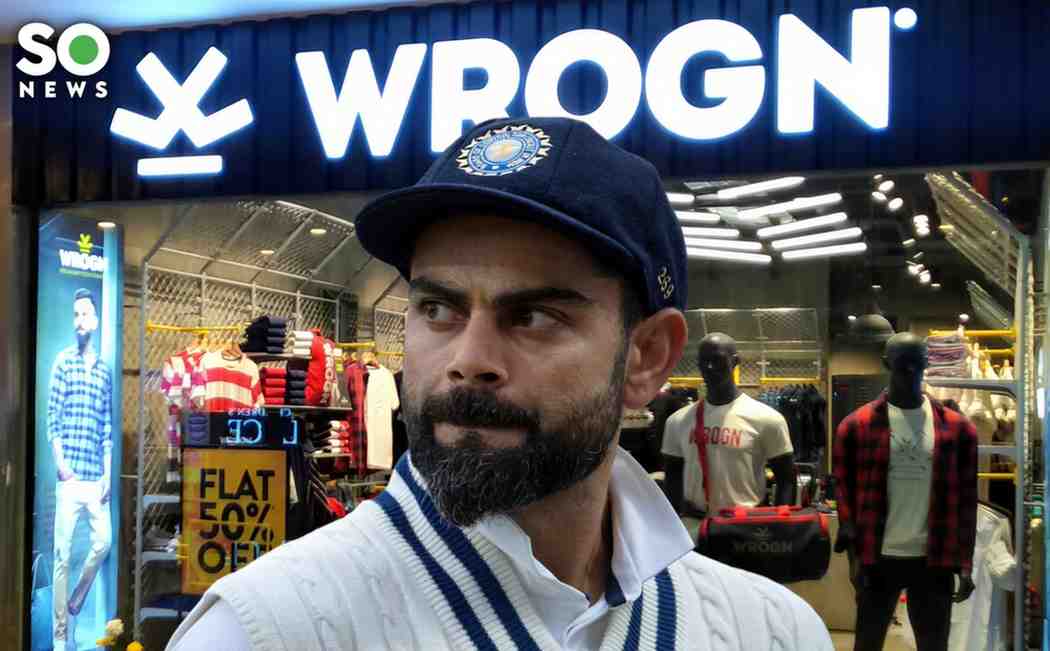

Casualwear brand Wrogn, backed by Indian cricketer Virat Kohli, reported a 12.5% decline in revenue to ₹232 crore in FY25, even as losses increased due to a sharp rise in advertising and promotional spending. The performance reflects pressure in the apparel market and higher costs linked to brand visibility efforts.

Revenue Decline Amid Challenging Market Conditions

Wrogn’s revenue drop in FY25 comes amid a competitive and demand-sensitive apparel market, where discretionary spending has remained uneven. Industry experts said fashion brands catering to youth segments have faced headwinds due to changing consumption patterns and intense competition from both domestic and international labels.

The decline marks a reversal from earlier growth phases, prompting a renewed focus on efficiency and portfolio optimisation.

Losses Widen as Ad Spend Rises

The company’s losses widened during the year, largely driven by a significant increase in advertising and marketing expenditure. Wrogn stepped up spending to strengthen brand recall, expand digital reach, and drive sales across online marketplaces and offline channels.

While higher ad spend can support long-term brand building, analysts noted that the immediate impact on profitability has been negative, especially in a year of softer revenue performance.

Strategy Focused on Visibility and Scale

Wrogn has continued to invest in visibility across digital platforms, influencer-led campaigns, and retail presence to maintain relevance among young consumers. The brand’s strategy has emphasised scale and reach, particularly through e-commerce and fashion marketplaces.

Management believes sustained marketing investments are necessary to compete in a crowded segment, though balancing growth and profitability remains a key challenge.

Virat Kohli’s Association and Brand Positioning

Virat Kohli remains closely associated with Wrogn’s identity, helping the brand maintain strong recognition in the youth fashion space. His involvement has been central to Wrogn’s positioning as a bold, contemporary menswear label.

However, analysts note that celebrity-backed brands still need strong fundamentals, efficient supply chains, and differentiated products to sustain long-term growth beyond endorsements.

Broader Apparel Industry Pressures

The wider apparel and fashion industry has seen margin pressure due to rising marketing costs, discounting on marketplaces, and fluctuating raw material prices. Brands are increasingly spending more to acquire and retain customers, which has weighed on near-term profitability.

Market observers say companies are now being forced to reassess growth strategies and focus on improving unit economics.

Outlook

Going forward, Wrogn is expected to focus on tighter cost control, optimising marketing spends, and refining its product mix to improve margins. The company may also look to strengthen its omnichannel strategy to drive more consistent demand.

While FY25 presented challenges, industry analysts say the brand’s strong recognition provides a foundation for recovery, provided it can align growth ambitions with sustainable profitability.