AceVector Group, the holding company behind Snapdeal and Unicommerce, has quietly filed draft IPO documents under SEBI’s confidential route-signaling its intent to enter India’s stock markets for the first time.

What’s Happening?

- Filing Made Public via Advertisement

On July 19, AceVector announced through a newspaper ad that it has submitted a draft Red Herring Prospectus (DRHP) under SEBI’s confidential filing process. - Confidential Route Gaining Popularity

This pathway allows companies to file IPO plans discretely, keeping key details under wraps until they’re ready to launch, offering strategic flexibility. Companies like Groww, boAt, Shadowfax, and PhysicsWallah have used the same approach.

AceVector at a Glance:

- Leadership & Portfolio

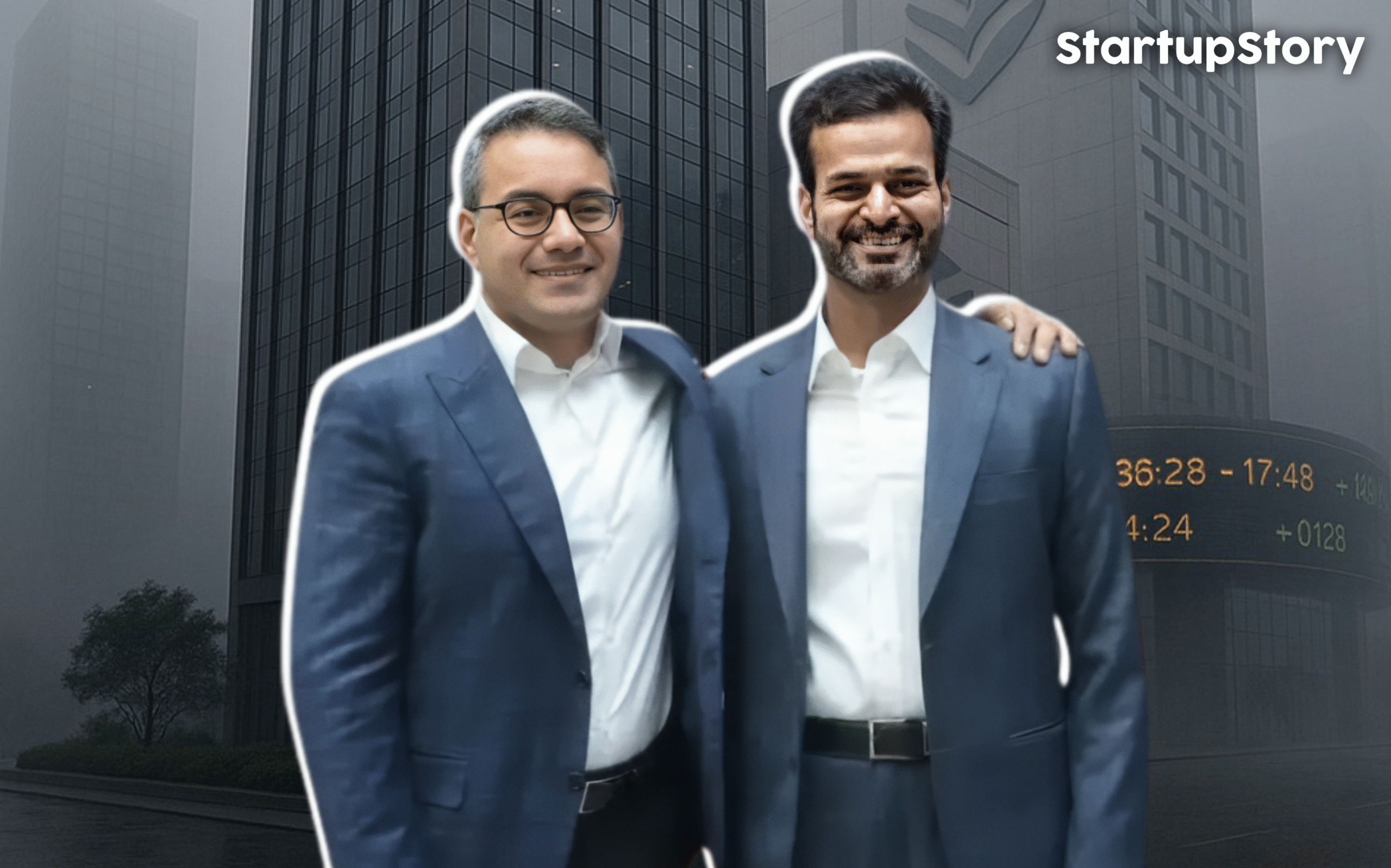

Founded by Kunal Bahl and Rohit Bansal, AceVector not only backs Snapdeal but also operates Unicommerce (a SaaS-based e-commerce enablement platform) and Stellaro Brands. The company holds over 28% in Unicommerce. - Unicommerce IPO Success

Unicommerce went public in August 2024 at ₹108 per share and surged over 100% on debut, though it’s currently trading near ₹129.

Business Snapshot: Unicommerce & Snapdeal

- Unicommerce (FY25)

- Revenue: ₹135 Cr (↑30%)

- Net Profit: ₹18 Cr (↑34%)

- Snapdeal (FY24)

- Operating Revenue: ₹380 Cr (↑2%)

- Losses: ₹160 Cr (↓43%)

Why the Confidential Filing Matters:

- Extended Timeline

Firms using this route can delay their IPO launch: they get up to 18 months (instead of 12) after SEBI’s final comments. - Dynamic Issue Sizing

Flexibility to alter the size of the capital raise by up to 50% until the updated DRHP is filed.

Context: IPO Minisurge Among Indian Startups

This filing is part of a broader wave-over a dozen Indian tech and startup companies, including Meesho, Pine Labs, Curefoods, Urban Company, and others, have filed DRHPs aiming to collectively raise around ₹18,000 Cr-plus.

AceVector’s IPO Strategy: What to Expect

- Mixed Offering Approach

Likely to include a fresh issuance (raising new capital) along with an Offer-for-Sale (OFS), enabling early investors or founders to partially cash out. - Merchant Banking Partners

CLSA and IIFL Capital are reportedly brought on board to manage the IPO process.

Why It Matters:

- Unlocking Value

Snapdeal and Stellaro’s valuations have been private until now, and AceVector’s listing could reveal their market worth. - Tech IPO Momentum

This marks another milestone in India’s growing trend of high-growth tech listings-a resurgence following last year’s major IPOs like Swiggy, Ola Electric, and FirstCry.