Ola Electric’s promoter has pledged over 10.71 crore shares of the company, worth around ₹1,071 crore, to secure debt financing for its AI and data centre venture, Krutrim Data Centre Pvt Ltd. This move is meant to raise capital through debentures, helping Krutrim expand its infrastructure as it develops advanced AI capabilities.

What’s the Share Pledge All About

- The pledged shares amount to 10,71,70,404 equity shares, which represent about 2.43% of Ola Electric’s total equity capital.

- From the promoter’s holdings, this corresponds to about 8.09% of their stake.

- These shares have been pledged in favour of Axis Trustee Services Ltd, acting on behalf of multiple lenders including Avendus Structured Credit Fund II, Avendus Finance Pvt Ltd, and the Incred Credit Opportunities Funds. The pledge is meant to back debentures issued by Krutrim Data Centre Pvt Ltd.

Replacing a Previous Undertaking

- This new pledge replaces an earlier Non-Disposal Undertaking (NDU) involving the same set of shares. The NDU was put in place earlier when the promoter’s share lock-in period expired under SEBI regulations.

- During the transition from the NDU to the pledge, some records may temporarily show the shares as pledged twice in depository systems until the old undertaking is fully released.

Market Reaction & Impact

- As soon as this pledge was disclosed, Ola Electric’s stock saw a drop, shares dipped around 4-5%, hitting lows in intraday trading.

- The announcement triggered concern among investors since pledging promoter shares is often seen as a sign that a firm needs external financing. But in this case, it appears to be a strategic move to back Krutrim’s data centre expansion rather than an indication of distress.

Why It Matters

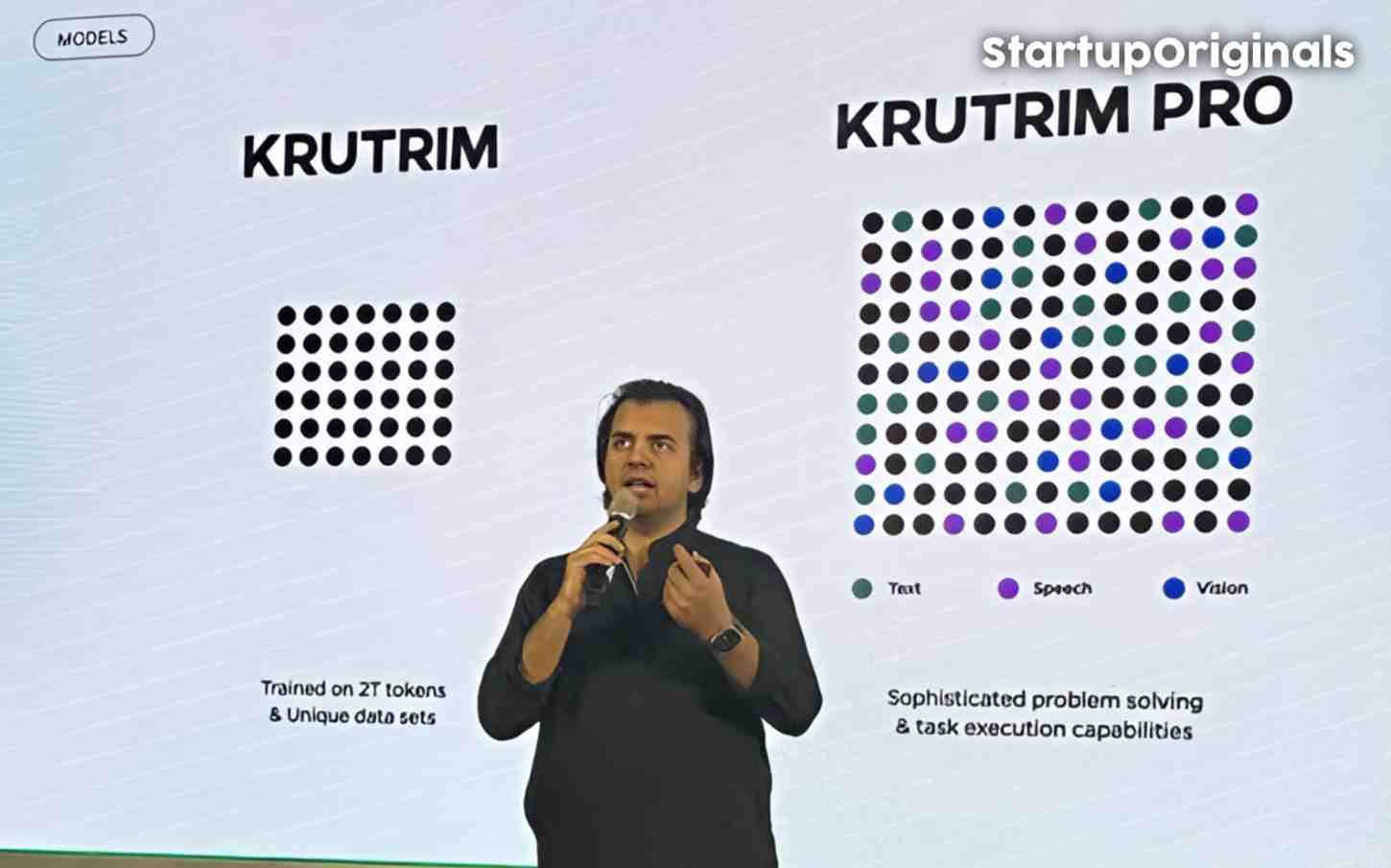

- Krutrim’s Ambitions: Krutrim, founded by Ola Electric’s promoter Bhavish Aggarwal, is building artificial intelligence infrastructure, including data centres, and is part of India’s push toward home-grown AI capabilities. Securing funds via pledging shares helps Krutrim raise capital without diluting Ola Electric’s equity significantly.

- Equity vs Debt Balance: Using debentures backed by promoter shares allows Krutrim to raise debt without issuing new shares, instead using existing shares as collateral. It’s a way to leverage existing assets for financing growth.

What to Watch Going Forward

- How Krutrim uses the capital, whether it translates into improved infrastructure, enhanced data centre capacity, or AI tools.

- Whether further share pledging happens, which could affect investor confidence if overdone.

- Performance of Ola Electric stock, especially if sentiment sours or if the financial leverage becomes heavier.