In a bold move to reduce dependency on China and strengthen its critical minerals supply chain, India is preparing to introduce incentives for domestic rare earth production. These minerals-essential for everything from electric vehicles to smartphones and defense technologies-are at the heart of the global clean energy and tech transition. With China controlling more than 85% of global rare earth processing, India’s plan is a step toward economic security and geopolitical leverage.

Why Rare Earths Matter:

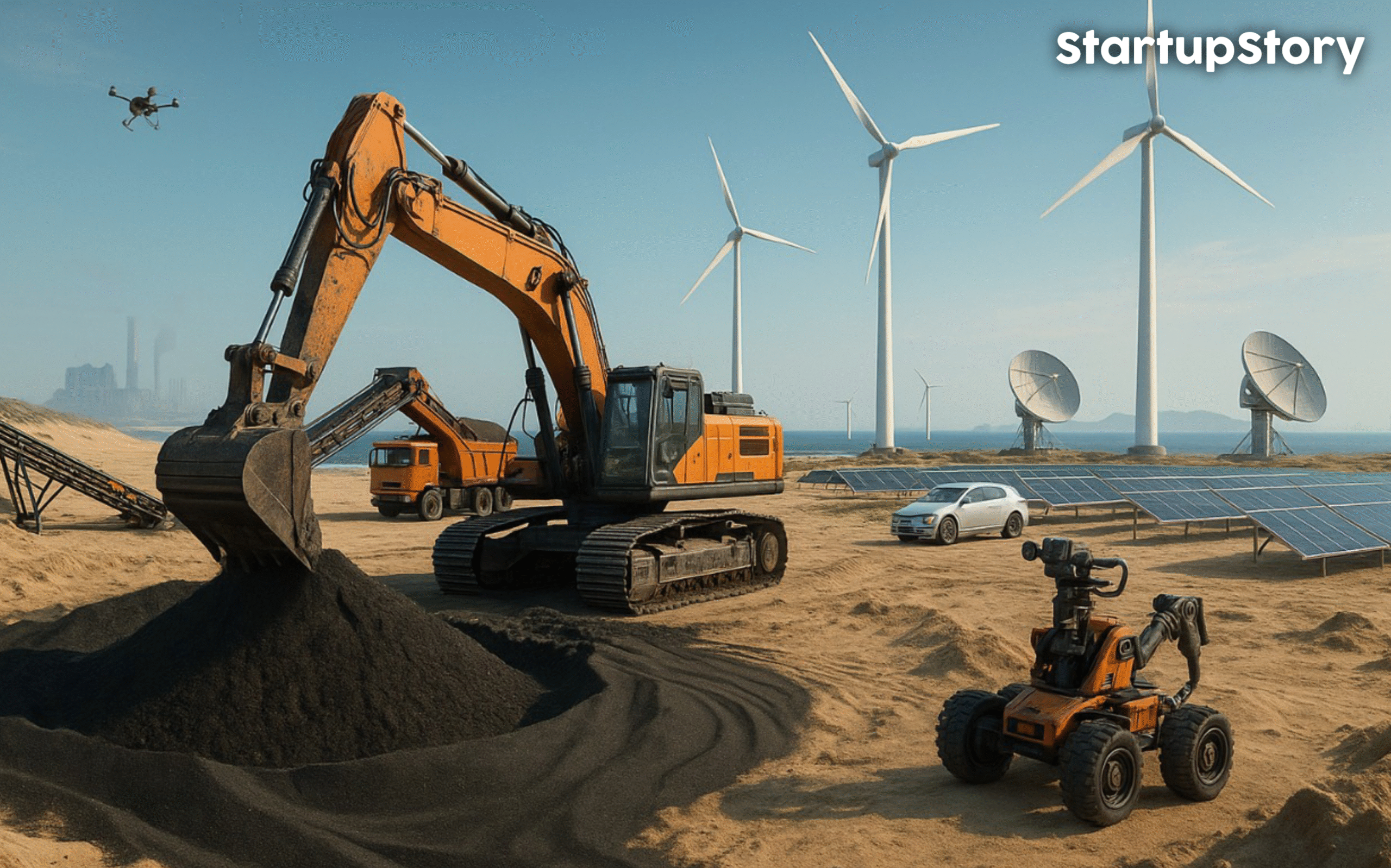

Rare earth elements (REEs) are not as rare as their name suggests, but extracting and processing them is highly complex and environmentally sensitive. They are indispensable in manufacturing:

- Electric vehicle batteries

- Wind turbines

- Smartphones and laptops

- Military-grade equipment (e.g., missiles, radar systems)

As the world races towards green energy and digital transformation, the demand for REEs is set to surge.

The China Factor: A Wake-Up Call for India.

China’s grip over the rare earth supply chain has long been a strategic advantage. Over the years, it has used its dominance as a geopolitical tool-restricting exports during disputes, raising prices, and threatening global supply stability.

India, despite having reserves, has lagged behind due to outdated policies, lack of private sector participation, and weak downstream infrastructure. Now, with global tensions rising and China growing unpredictable, the Indian government is working to change that.

What India Is Planning:

The Indian government is reportedly considering a range of reforms, including:

- Production-linked incentives (PLI) for private companies entering rare earth mining and processing

- Public-private partnerships with PSUs like IREL (India) Ltd

- Liberalizing exploration and mining policies to attract investment

- Developing refining and value-added capabilities, not just raw extraction

The broader goal is to build a full-stack rare earth ecosystem-from exploration to advanced processing.

India’s Current Position:

India has substantial reserves of rare earths, especially monazite sands found in coastal states like Odisha, Tamil Nadu, and Kerala. However, these are currently controlled by state-owned enterprises, with limited commercial scale exploitation.

With the right policy push and technology transfer, India could become a serious player in the rare earth supply chain-supporting not only its domestic manufacturing ambitions but also becoming a reliable alternative for global markets wary of overdependence on China.

The Global Context: Allies Want India In.

India’s rare earth ambitions also align with global interests. Countries like the US, Japan, and Australia are actively seeking to diversify their rare earth sources. This creates an opportunity for India to emerge as a trusted supplier, especially if it partners with Western allies for technology and investment.