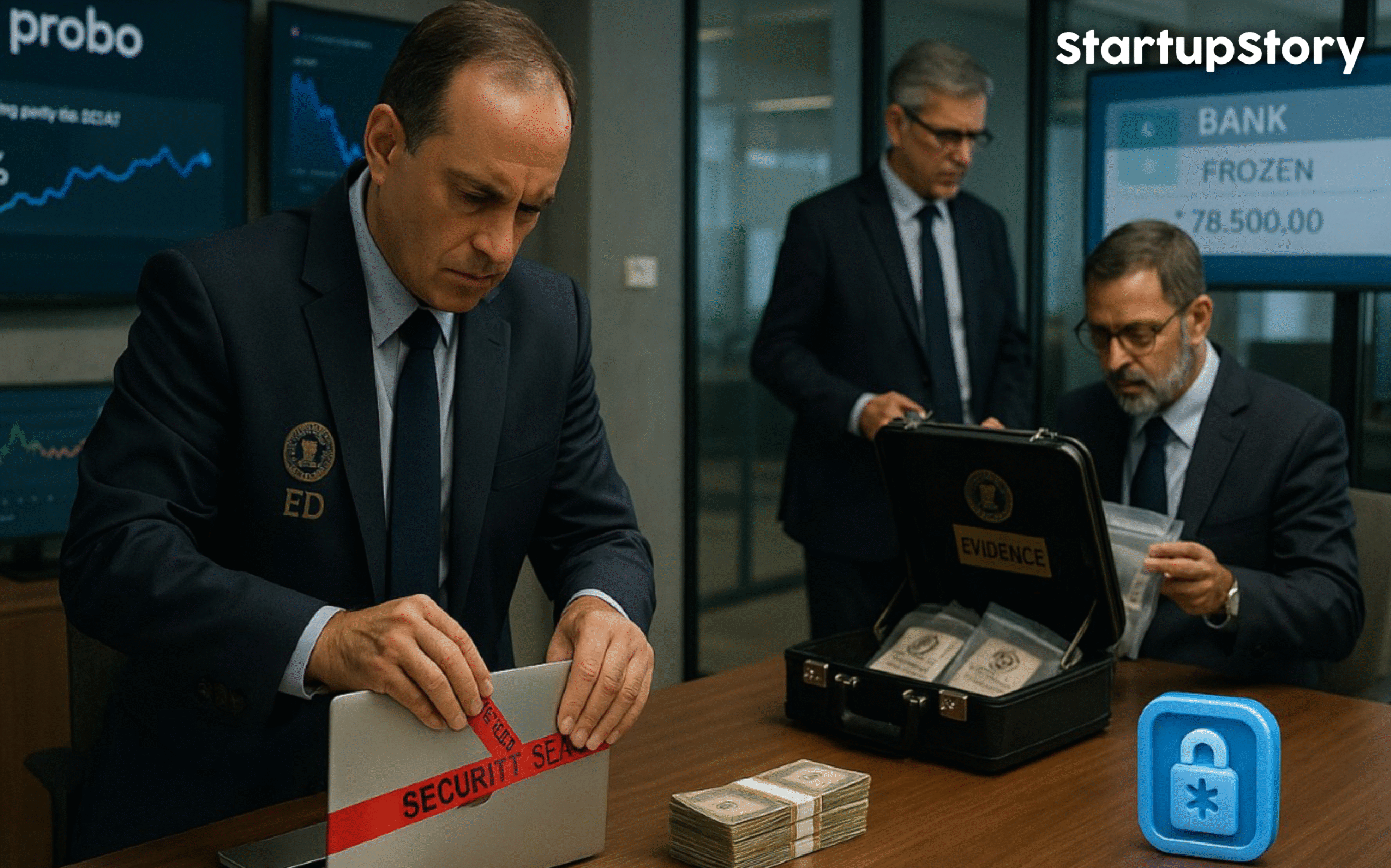

In a major move, the Enforcement Directorate (ED) has seized assets worth ₹284 crore from Probo, an opinion trading platform, as part of a money laundering probe. This enforcement action puts the spotlight on India’s booming but loosely regulated prediction market space. Once seen as a rising startup in the fintech-meets-gaming world, Probo now faces serious legal and regulatory heat.

What Is Probo and Why Was It Raided?

Probo is a platform that allows users to trade on the outcome of real-world events – from politics and sports to finance and entertainment. Think of it as a stock market for opinions, where users “buy” predictions they believe will come true.

The ED’s case against Probo stems from concerns that this trading model allegedly violates India’s gambling laws, and that the funds circulating through the platform may be part of a money laundering network.

The raids were conducted under the Prevention of Money Laundering Act (PMLA), following inputs from law enforcement agencies that suspected Probo was facilitating betting under the guise of opinion trading.

₹284 Crore in Frozen Assets: What It Includes.

According to the ED, the seized assets include:

- Bank account balances

- Fixed deposits

- Proceeds believed to be generated from illegal activities

This massive ₹284 crore seizure is one of the biggest in recent memory involving a startup, and it highlights the growing scrutiny of emerging fintech platforms in India.

What Is the Allegation? Betting or Trading?

Probo has long defended its model by claiming that it is not a gambling platform, but an information market – where users make predictions based on public knowledge. However, the ED believes that the mechanics of the platform resemble online betting, which is prohibited in many Indian states.

Authorities argue that Probo:

- Collected large sums of money from users in the name of trading

- Did not have the required regulatory licenses

- Failed to comply with financial reporting norms

These activities, according to the ED, led to the accumulation and circulation of suspicious funds.

Startups in the Grey Zone: A Growing Trend.

Probo’s case is not isolated. Several Indian startups operating at the intersection of tech, gaming, and finance are finding themselves in regulatory limbo. With no clear rules for prediction markets in India, platforms like Probo have been able to grow rapidly – until enforcement agencies step in.

This crackdown could signal a wave of regulatory tightening, especially as authorities aim to ensure that digital platforms don’t become fronts for money laundering or illegal betting.

What Happens Next for Probo?

Probo has not yet issued a detailed public statement in response to the ED’s actions. If the allegations are proven true, the platform could face severe legal consequences, including:

- Heavy financial penalties

- Possible criminal prosecution

- A ban or restrictions on operations

Startups in this space may now need to rethink their models and possibly come under the purview of stricter financial and gaming regulations.