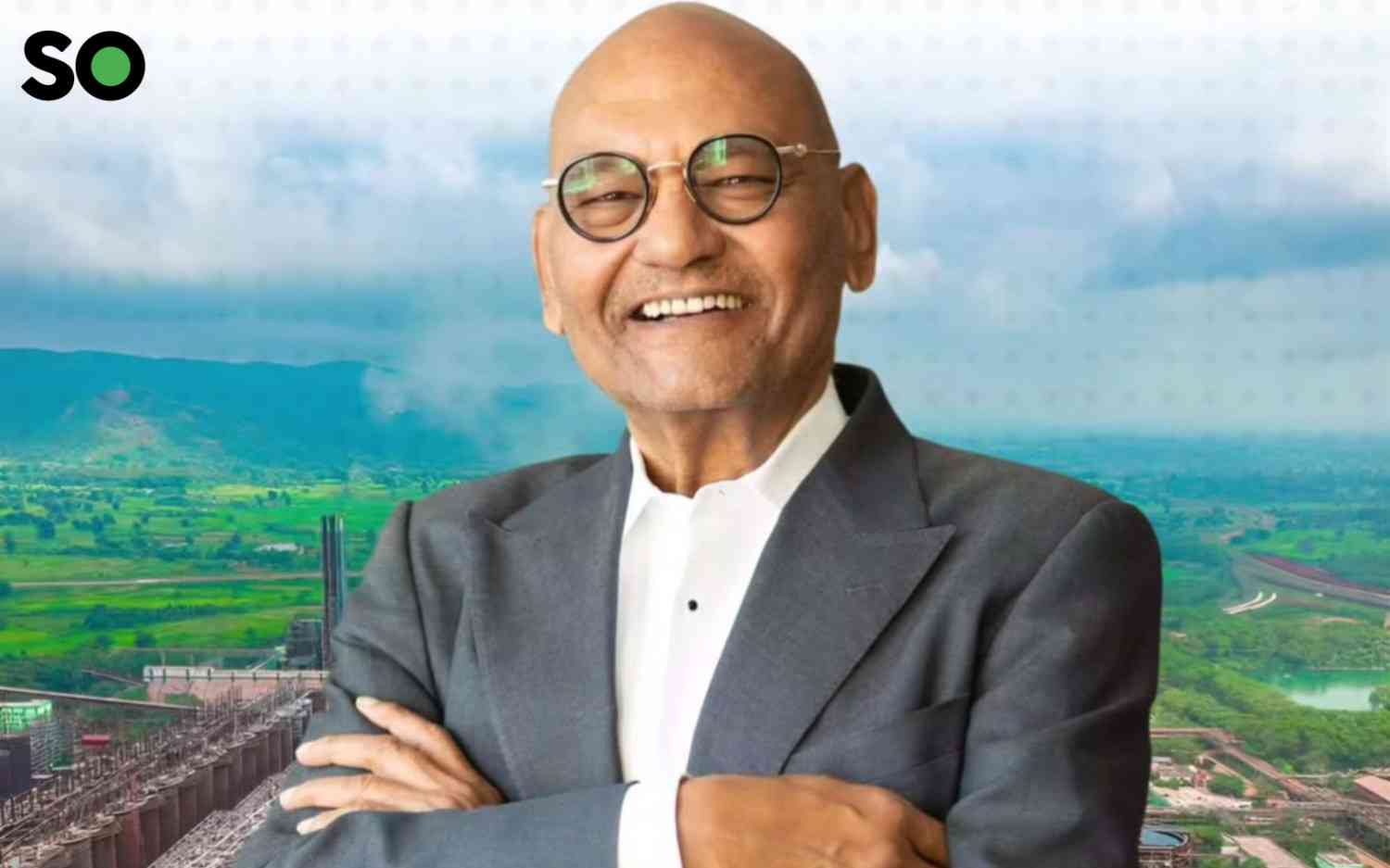

Every empire begins with a decision, and for Anil Agarwal, it began with courage. Leaving behind the safety of home at just 19, armed with little money but unstoppable ambition, he set out from Patna to Mumbai. Decades later, that journey has shaped one of India’s largest natural resources conglomerates: the Vedanta Group.

From Patna to Big Dreams

Anil Agarwal was born into a Marwadi family in Patna, Bihar. His father, Dwarka Prasad Agarwal, ran a small aluminium conductor business, exposing young Anil to the basics of trade early in life. Educated at Miller High School, Patna, Anil chose real-world experience over college. In 1968, at the age of 19, he left for Mumbai, India’s commercial capital, determined to build something of his own.

Nine Failures Before the Breakthrough

The early years were harsh. Agarwal experimented with nine different businesses, and every one of them failed. Financial struggles were constant, and survival itself became a challenge. Yet, quitting was never an option.

In the mid-1970s, his tenth attempt finally showed promise. He began trading scrap metal, sourcing waste from cable companies across states and selling it in Mumbai. What looked like a small, unglamorous business became the first brick in a massive industrial empire.

The Birth of Sterlite Industries

In 1976, backed by a bank loan, Agarwal acquired Shamsher Sterling Corporation, a manufacturer of enameled copper. By 1986, he set up a factory to manufacture jelly-filled cables and formally founded Sterlite Industries.

However, he soon realised a critical flaw, profits were vulnerable to fluctuating copper and aluminium prices. His solution was bold and strategic: control the raw materials instead of depending on them.

Vertical Integration: A Game-Changing Move

The 1990s marked a turning point.

- 1993: Sterlite set up India’s first private copper smelter

- 1995: Acquired Madras Aluminium, a closed PSU under BIFR

These moves allowed Agarwal to integrate operations from mining to manufacturing, reducing risk and stabilising margins, a rare strategy at the time.

How Vedanta Came Into Existence

India’s disinvestment programme opened unprecedented opportunities.

- 2001: Acquired 51% stake in BALCO for ₹551.5 crore

- 2002: Acquired nearly 65% stake in Hindustan Zinc

To access global capital, Agarwal incorporated Vedanta Resources Plc in London in 2003, making it the first Indian company listed on the London Stock Exchange. Through restructuring, assets such as Sterlite Industries, BALCO, and Hindustan Zinc were brought under one umbrella, giving birth to the Vedanta Group.

Rise of Vedanta Limited

Vedanta Limited emerged as the group’s Indian flagship. Strategic global acquisitions followed, including:

- Konkola Copper Mines (Zambia)

- Sesa Goa (iron ore)

- Anglo American’s zinc assets in Africa and Europe

- Cairn India (oil and gas)

Today, Vedanta operates across India, Africa, and the Middle East, with a market capitalisation of approximately ₹2,38,500 crore.

Legacy, Loss, and Giving Back

As of today, Anil Agarwal’s net worth stands at around ₹31,500 crore. Recently, his family faced a tragic loss when his son Agnivesh Agarwal passed away at 49 following a skiing accident.

Father and son had shared a powerful commitment, to give back more than 75% of their wealth. Their vision focuses on ending hunger, ensuring education for every child, empowering women, and creating meaningful employment for India’s youth.

Conclusion

Anil Agarwal’s journey is not just about metals, mining, or market capitalisation. It is a story of resilience, strategic thinking, and belief. From nine failed ventures to building a ₹2.38 lakh crore empire, his life proves one timeless truth: where you start does not define how far you can go.