In April 2024, PeepalCo, the parent company behind crypto-unicorn CoinSwitch, launched Lemonn, a fresh stock-market investing and trading app aimed at simplifying equity investing for Indians. Within 18 months, Lemonn reportedly amassed around 2 million users, marking one of the fastest growth trajectories in India’s online broking space.

Why Lemonn Was Built: From Crypto to Regulated Investing

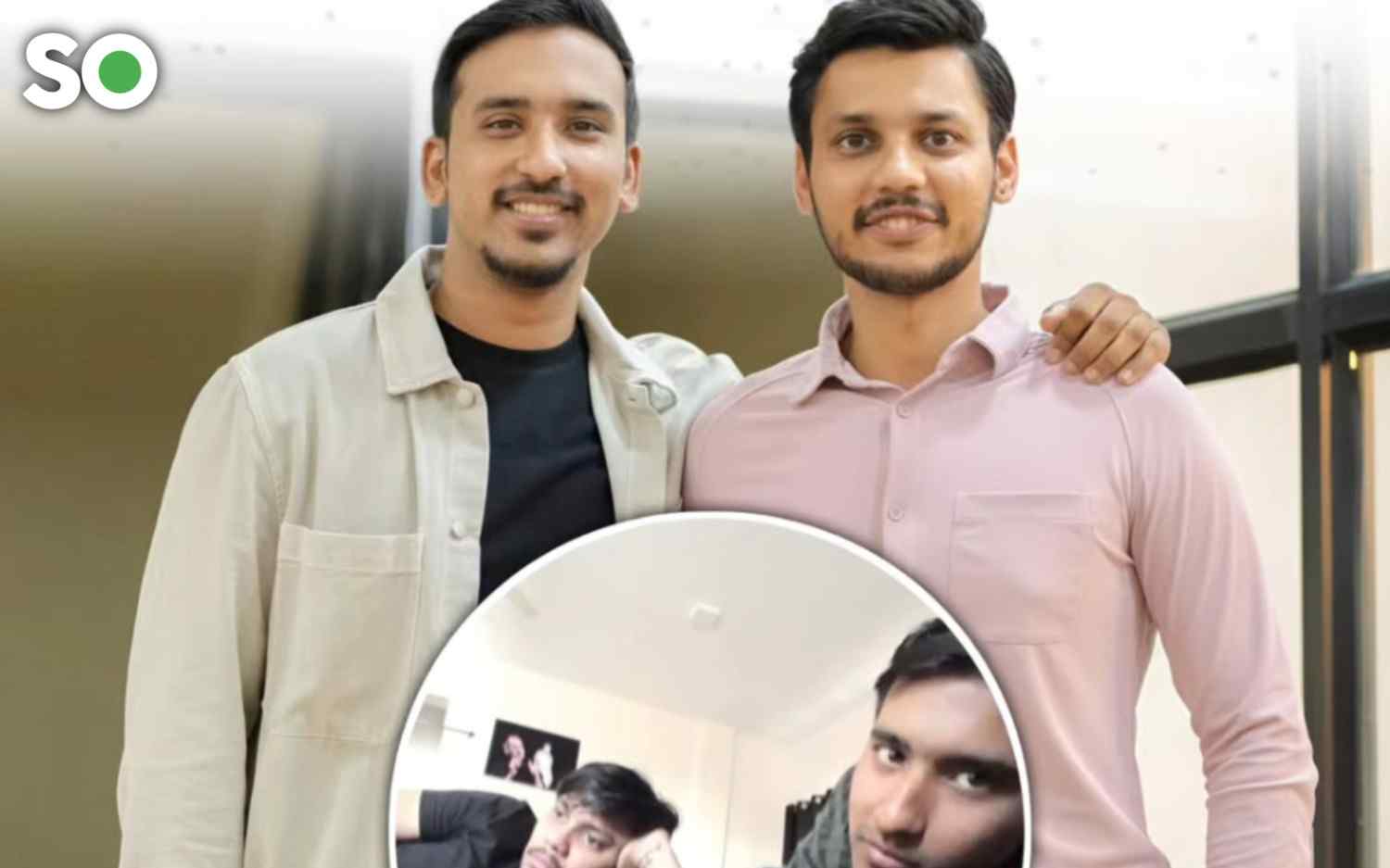

- The founders, Ashish Singhal, Govind Soni and Vimal Sagar Tiwari, had already built CoinSwitch, India’s popular crypto platform. As they looked toward a regulated future and broader financial offerings, they decided to enter India’s equity markets.

- The vision behind Lemonn was clear: make stock investing simple, accessible and friendly, especially for first-time investors, rather than catering only to sophisticated traders.

- Lemonn was launched under a separate entity, licensed and regulated for stock broking, to ensure compliance and separation from crypto operations, while targeting the large under-penetrated base of Indians who do not yet invest in the stock market.

Early Traction & Growth: User Adoption and Momentum

- Within just five months of its launch, Lemonn reportedly crossed 500,000 users.

- By late 2025, the app claimed to have hit nearly 2 million users, underscoring rapid adoption and strong demand for a fresh entrant.

- According to its website and public profiles, Lemonn now ranks among the top 50 brokers in India in terms of unique active clients, a meaningful benchmark for any new broking platform.

What Lemonn Offers: Features and User-Friendly Proposition

Lemonn differentiates itself through a combination of ease-of-use, broad services, and trading-friendly features:

- Zero brokerage and zero account-opening fees at launch – making it low-cost and low-entry barrier for new users.

- All-in-one investing & trading platform – allowing users to trade stocks, futures & options, mutual funds, IPOs, margin trading, etc., all from a single app.

- Beginner-friendly interface and tools – including curated stock lists, educational glossary, intuitive UI, and trading-ready features for advanced users.

- Focus on “discovery” and clarity – rather than overwhelming users with jargon, Lemonn aims to help first-time and casual investors navigate the market with confidence.

What This Success Story Reflects – Key Takeaways

- Tapping unmet demand: With only a small fraction of Indians investing in the stock market, Lemonn’s entry demonstrates that a large untapped audience remains, especially among youth and first-time investors.

- Simplicity + accessibility = growth: By removing cost and complexity barriers, Lemonn lowered the threshold for participation, enabling quicker adoption.

- Regulated, trusted expansion of fintech brands: Transitioning from crypto (risky/unregulated) to regulated stock-market broking shows foresight; Lemonn leverages the founders’ fintech experience but adapts to India’s regulatory climate.

- Blending for beginners & traders: Offering tools for both novice investors and active traders positions Lemonn well to grow with its users over time.

Challenges Ahead & What to Watch

- It’s one thing to acquire users, converting them to active, long-term investors takes robust education, transparency, and trust. How Lemonn retains and grows its user base will be critical.

- With many established players (discount brokers, fintech apps), differentiation will be key. Sustaining low costs while investing in technology, compliance, and customer experience will test the business model.

- Regulatory scrutiny in financial markets, margin trading, derivatives, and user protection, means the startup must stay compliant and transparent to succeed.

Conclusion: From Crypto Roots to Broader Financial Vision

Lemonn’s journey – from a launch in 2024 to millions of users today, is a strong example of how fintech companies can evolve. By combining the founders’ fintech pedigree, an untapped market, and a user-friendly product, Lemonn shows that there is still space to build new-age investing platforms in India. If it continues on this trajectory, it could significantly influence how thousands of Indians discover, invest in, and grow with markets in the coming years.