Mazagon Dock Shipbuilders Limited (MDL), a government-owned defence PSU based in Mumbai, has announced its first international acquisition – a controlling stake in Colombo Dockyard PLC (CDPLC), the largest shipbuilding and repair facility in Sri Lanka. The total investment for this acquisition is estimated at around USD 52.96 million, which is approximately ₹452 crore. The move signals MDL’s intent to expand beyond Indian borders and become a significant player in the regional maritime landscape.

Deal Structure and Approvals:

The acquisition will involve both a primary capital infusion into CDPLC and a secondary purchase of shares from existing shareholders, including Onomichi Dockyard Co. Ltd of Japan. The board of directors at MDL has already approved the deal. However, the transaction is subject to necessary statutory and regulatory clearances, which are expected to take about four to six months to complete.

Strategic Significance:

This deal is being seen as a strategically important step for India in the Indian Ocean region. Colombo Dockyard is located in the Port of Colombo, which lies along one of the busiest international shipping lanes. By acquiring a controlling interest in CDPLC, MDL will gain a foothold in this vital maritime corridor. It will also help India enhance its influence in the region, particularly in the context of increasing Chinese presence in nearby waters. For MDL, this is a shift from being a domestic defence shipbuilder to a more global, diversified player.

About MDL and Colombo Dockyard:

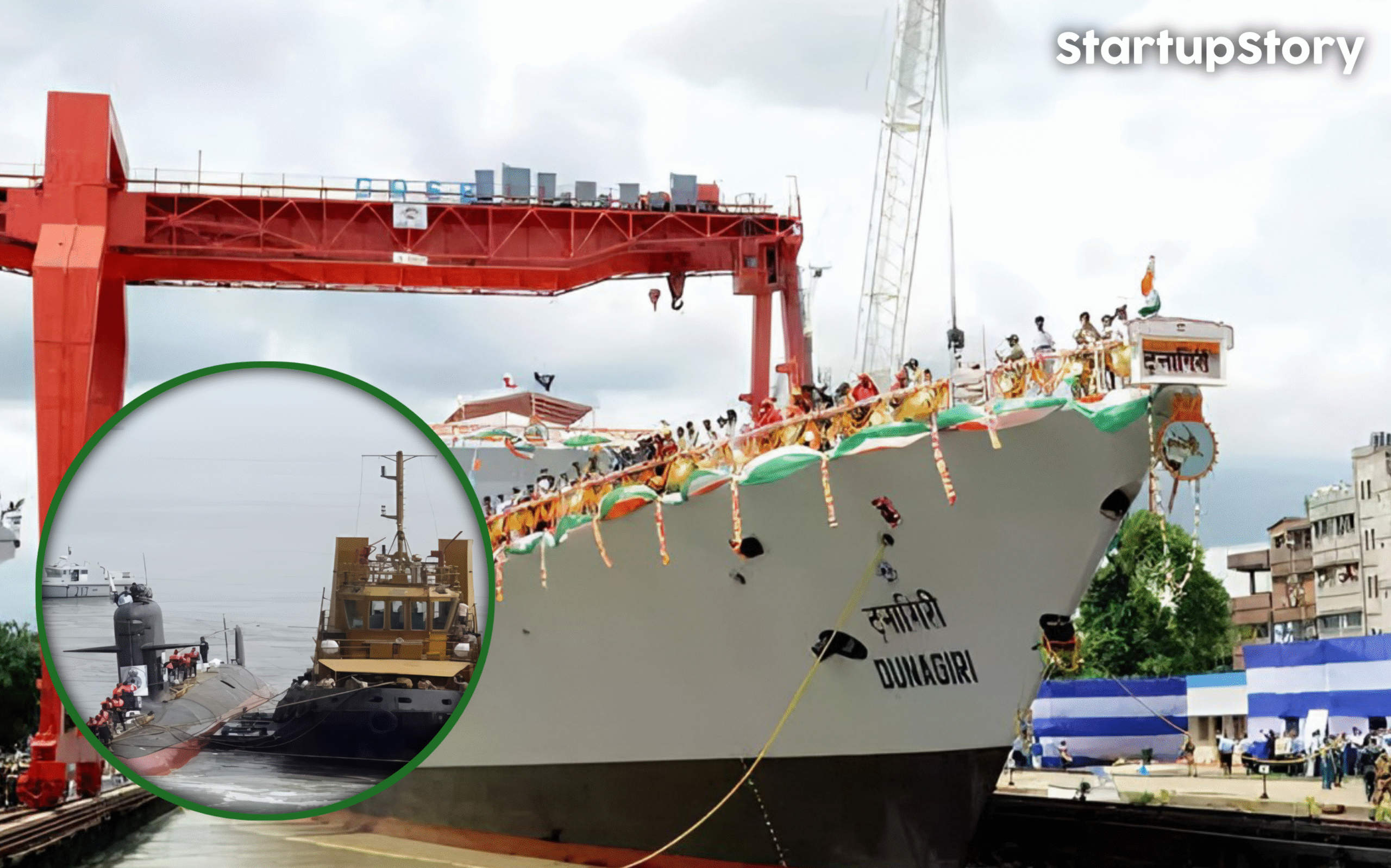

Mazagon Dock Shipbuilders is one of India’s premier shipyards, established in 1934, and is classified as a Navratna PSU. It is best known for building warships, submarines, offshore platforms, tankers, and patrol vessels for the Indian Navy and Coast Guard. Colombo Dockyard PLC, on the other hand, was founded in 1974 and is listed on the Colombo Stock Exchange. It operates four dry docks and several repair berths, capable of handling vessels up to 125,000 DWT. CDPLC holds various international quality certifications, including ISO 9001:2015, and serves clients across Asia, the Middle East, Africa, and Europe. As of the financial year 2024, CDPLC reported a consolidated revenue of LKR 25,447 million (around ₹726 crore) and a net worth of LKR 5,311 million.

Capabilities and Ongoing Orders:

Colombo Dockyard has over five decades of experience in constructing a wide range of vessels, such as offshore support vessels, tankers, cable-laying ships, and patrol boats. The shipyard currently has a strong order book valued at over USD 300 million. This includes construction of cable-laying vessels, utility ships, and fleet support vessels for domestic and foreign clients. These projects underline the operational strength and global demand for Colombo Dockyard’s services.

Expected Benefits and Future Plans:

The acquisition is expected to bring several long-term benefits. MDL aims to leverage operational synergies between the two shipyards, share technology and engineering expertise, and integrate supply chains. The goal is to make CDPLC more competitive and profitable while also expanding MDL’s own reach in global maritime markets. The deal also aligns with India’s broader strategy of promoting regional cooperation, increasing self-reliance in defence and maritime capabilities, and creating a strong, multi-location shipbuilding ecosystem rooted in Indian know-how.